Tax season is well under way and for some college students, filing taxes can be just as stressful as preparing for final exams.

Tax season is well under way and for some college students, filing taxes can be just as stressful as preparing for final exams.

With the proper research, resources, and time, filing taxes can be become relatively simple and the last minute rush can be avoided. Should students need to file taxes, the Ferris Accounting Association is one option students can turn to for assistance.

The organization provides students with help on their tax documents for a fee. They charge $6 for completing a tax return plus an additional $2 for each document needed to complete the return, such as a W-2, 1098, 1099 and others.

“The cost is very cheap compared to any other method of completing your tax return,” said James Heine, a member of the Accounting Association that is in charge of the program. “All students have to do is show up, fill out a short questionnaire with information needed to complete their return, and give us their documents.”

All money that is collected goes toward the organization. Any interested students can get help from 11 to 11:30 a.m. in Business 216 every Thursday until April 8. Students must first email the Accounting Association before attending one of these sessions. They can be reached at fe*************************@***oo.com.

Heine also suggested students take advantage of web sites and programs, such as TurboTax, that assist students in completing their return.

The Internal Revenue Service is offering college students and first-time filers something that can ease the federal tax return process.

Free File is a tax software program provided by the IRS and other private sector partners that allows people to prepare and electronically submit their federal tax return for free. The program follows an easy-to-use service that asks users questions and then completes the appropriate tax forms based on user’s answers. New taxpayers can find and utilize Free File at www.irs.gov/freefile where they can choose from about 20 different program options.

There are two different formats to federal Free File: Traditional Free File which is the step-by-step program that is offered by participating companies, and the Free File Fillable Forms which is the electronic version of the IRS paper forms that do simple math.

Each program has different eligibility requirements but anyone making less than $54,000 can find at least one option to choose. There is no income limitation for the Free File Fillable Forms, but would most likely be the best option for people comfortable filing their own taxes. Both formats are free and allow for free electronic filing.

Students must also remember to file city income taxes as well. Big Rapids income tax forms may be downloaded from the city’s web site, www.ci.big-rapids.mi.us. City tax returns must be filed by April 30, while state and federal taxes are due by April 15.

Returns and remittances with the proper wage and tax statements can be mailed to the city at 226 N. Michigan Ave. or dropped off at City Hall. Payments should be made payable to the “City of Big Rapids.”

Heine said, “The tax return is usually simple and won’t change a whole lot from year to year unless something drastic has changed with their income.”

He also added that students should look into the various educational tax credits and deductions that are available to students.

“The education credits are very common for students that claim themselves,” he said. “If the student puts in a little extra effort to learn about them, it will definitely pay off.”

There are a few different educational tax credits that students can qualify for. Only the one that claims the student as a dependent can claim these credits. Typically they only qualify for one or two, not all of them.

The Hope Scholarship Credit provides a tax credit for up to 100 percent of the first $1,000 in tuition and fees and up to 50 percent for the second $1,000. The maximum tax credit is $1,500 and only applies to the first two years of college.

The Lifetime Learning Credit gives a credit equal to 20 percent of tuition and certain related expenses up to $10,000. The credit maximum is capped at $2,000.

The higher education expenses deduction can be as much as $4,000 for families and individuals meeting certain income brackets. The American Opportunity Credit provides a maximum $2,500 credit for things such as tuition, books, and fees.

It is important for students determine whether or not their parents will be claiming them as a dependent. If their parents pay for more than 50 percent of the student’s expenses, the parents are eligible to claim the student as a dependent.

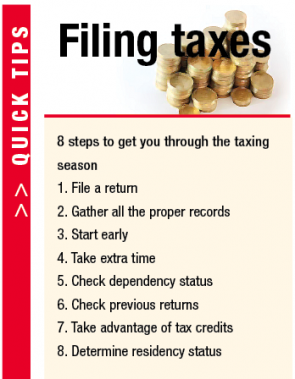

By taking the proper steps such as having all the proper paperwork in order, giving themselves a good amount of time, and starting early students can limit the amount of time and stress that is needed to file taxes and ensure that the process can go smoothly. n

i am a firm believer in outsourcing your documents to an accountant. My

accountant has found my thousands in tax breaks so he is worth all his

fees.

http://ctssac.com/